Under straight line method, the amount of depreciation is determined on the basis of cost price of asset. Therefore, first of all, cost price of machine (asset) will be ascertained.

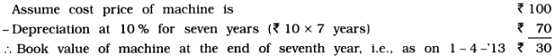

As given, book value of machine at the end of seventh year is ₹ 36,000

∴ Cost price of machine = ₹ 1,20,000

∴ Annual depreciation at 10% of ₹ 1,20,000 = ₹ 12,000

Selling price of machine:

Journal Entries of Hansa Limited :